High-risk businesses that are unable to get a payment gateway through a conventional payment processor or their bank are, in most cases, left looking for alternative methods to process their credit card payments. When looking for the ideal payment gateway for your high-risk business, you’ll come across a wide array of processing alternatives, including companies working exclusively with high-risk companies, and others working as payment hardware and aggregators who will allow merchants to accept credit card payments on tablets or smartphones. With such a wide array of options to select from, it can be a daunting task to find the ideal payment gateway for your high-risk business. Below are some of the vital features to confirm in a high risk merchant services company for your business.

Ensure it protects your business’ interests.

There are numerous features that most high-risk payment processing gateways have to protect you against fraud and other risky situations and transactions. The ideal payment gateways must be fully integrated with anti-fraud software to protect you from account closures resulting from high chargeback ratios. Some of these features can include multibank processing and chargeback alerts by using several supporting banks to alternate transactions across to keep the chargeback ratios as low as possible.

Ensure it accepts more than just credit cards.

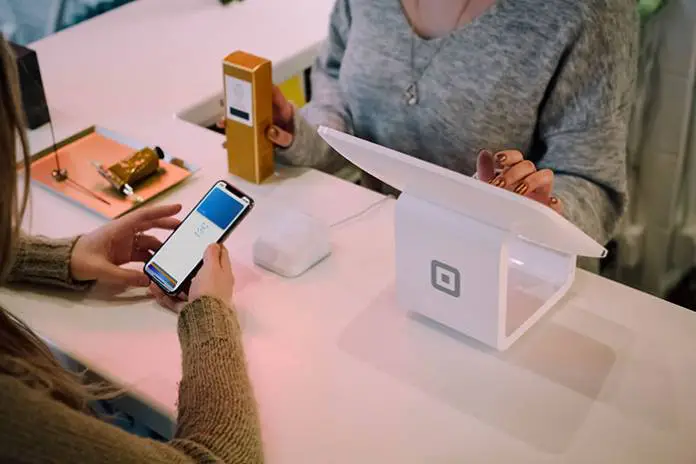

Although it’s vital to accept credit cards from clients, those without credit cards, or don’t want to use them, can fail to spend money if they don’t have alternatives. To avoid turning away potential customers looking for alternative methods of payment, ensure your payment gateway allows debit cards, mobile payments, and other major credit cards.

Anyway, the payment type that you go for will depend on whether you’re selling in person or online. If your business sells online, ensure your gateway accepts payments through Check 21 and ACH. If you sell physically in a store, for instance, you can add a mobile payment that will allow your clients to pay for services or goods through Samsung or Apple Pay.

Ensure the company processes transactions at a reasonable rate.

Since most, if not all, payment processors take on a massive risk by processing payments for your high-risk business, you may encounter higher rates than you expect. Conduct your research and compare fees, as different processing companies charge different fees before committing to an unreasonably high fee.

Ensure the company provides round-the-clock support.

For many businesses, especially those selling online, the business doesn’t stop after the end of the day. It is, therefore, imperative that you find a company offering round-the-clock business support services. These services can assist you to detect fraudulent transactions, or even help to investigate the suspicious transactions. Besides, they will assist in getting your terminal up and running in case of an outage.

Ideally, the perfect payment gateways for your business are those given by companies offering a full range of merchant services, such as chargeback alerts, 24/7 merchant support, fair fees, and fraud protection.