Shares of biotechnology company Biogen, Inc. (NASDAQ: BIIB) rose almost 10% thanks to rumors of a possible takeover of pharmaceutical giants Merck & Co., Inc. (NASDAQ: MRK) and Allergan, Plc. (NASDAQ: AGN) interested in Biogen’s profitable experimental drugs business.

However, anonymous sources have said that there have only been informal and preliminary meetings to know Biogen’s position on the matter and reportedly a deal could never materialize because the company may not be interested.

Most wanted: Biogen’s experimental drugs business

Although spokespersons from the companies involved either couldn’t be reached or declined to comment on the supposed takeover, Leerink Partners analyst Geoffrey Porges said Merck and Allergan are just two of several large drugmakers looking to acquire Biogen and profit from its innovative drugs business.

These drugs are used in late stage clinical trials to treat diseases such as Alzheimer’s, multiple sclerosis and spinal muscular atrophy. Porges added that “Merck nor Allergan have multiple sclerosis businesses today” and would hugely benefit from Biogen’s leading products in that field at a time where such valuable assets are rare.

As of now, no other companies have been named as potential buyers. But RBC Capital Markets analyst Michael Yee noted that Roche Holding AG (NASDAQ: RHHBY) would also be a logical suitor, given that the Swiss company already collaborates with Biogen selling lymphoma drug Gazyva.

Merck searching for ultimate Alzheimer’s treatment

Merck’s particular interest is more related to Biogen’s Alzheimer’s drug candidate called aducanumab.

Although Merck is currently testing a series of new Alzheimer’s treatments called BACE inhibitors, pharmaceutical rivals Eli Lilly and Company (NASDAQ: LLY) have them that the chronic disease could ultimately have a treatment with a combination of drugs. Allergan has taken that same approach as the company bought Forest Laboratories in 2014 and inherited its Alzheimer’s drug. So Merck wants to follow their footsteps with the acquisition of Biogen.

In March 2015, at the 12th International Conference on Alzheimer’s and Parkinson’s Diseases, the Biogen anti-amyloid antibody drug, aducanumab, showed why is one of the most-sought after experimental drugs on the industry, and especially by Merck.

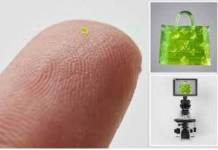

Aducanumab left analysts and scientists stunned as it seemed able to reduce amyloid significantly in patients’ brains and evidently slowed down cognitive degeneration. Amyloids are aggregates of proteins associated with more than 20 human diseases as well as neurodegenerative disorders.

Jim Mullen, the Biogen CEO at the time, explained that the deal was for Neurimmune to produce candidate molecules in exchange of $380 million from Biogen, which will develop and commercialize antibody-based treatments for Alzheimer’s disease. Aducanumab was the resulting drug that Merck so badly wants now.

Allergan to sell Anda drug distribution business to Teva: https://t.co/LETdstqb76 #pharma #acquisition #allergan

— Risk Strategies, Part of the Brown & Brown Team (@RiskStrategies) August 3, 2016

Biogen’s slow growth a key factor in potential takeover

Rumors of a possible acquisition have been circulating for quite some time but gained momentum after Biogen CEO George Scangos announced his retirement last week. Scangos will leave after Biogen finds a successor but his loss added to investors getting more and more tired with the slowdown in the company’s multiple sclerosis franchises could prove a key factor in Biogen is ultimately accepting a takeover to escape from a risky position.

Although Biogen took everyone by surprise after reporting strong second-quarter earnings, the biotech company’s flagship Tecfidera treatment for multiple sclerosis has been on a slow down growth spiral since earning $3.6 billion in sales in 2015. In fact, last year Biogen went through a significant restructuring process to cut costs and focus on core areas, such as neurology, which include treatments for Alzheimer’s disease.

The biopharma’s shares rose to nearly 10%, or $6 billion gain in market capital, today and since last June it climbed from $49 billion to $72 billion but mainly thanks to acquisitions rumors, meaning it could be a short rise.

Report: #Biogen targeted as takeover target https://t.co/X8v3BzimU9

— FOX Business (@FoxBusiness) August 2, 2016

Biogen moving forward on other fronts

Earlier this week, Biogen paid Ionis Pharmaceuticals (NASDAQ: IONS) a $75 million license fee to develop and commercialize Nusinersen, a drug for spinal muscular atrophy. Biogen exercised its buyout clause on the drug after positive results in Phase 3 clinical trials in infants and children with the condition. Nusinersen, expected to surpass the $2 billion in annual sales, is administered directly to the central nervous system using intrathecal injection once every 3–4 months.

Having allied in 2007 to develop Aducanumab for the Alzheimer’s disease program, currently in Phase 3, Neurimmune and Biogen extended their partnership in 2010 with three new programs focused on Parkinson’s disease, tauopathies, and frontotemporal dementia. Parkinson’s program recently entered in Phase 1 clinical testing.

Source: Reuters